Driven

by low production costs and significant demand growth expectations, China’s

functional oligosaccharide industry has surged production in recent years, but

demand didn’t keep pace. Hence, most producers are running on a very low

production rate and wait for higher consumer awareness of the healthy sugar

replacement.

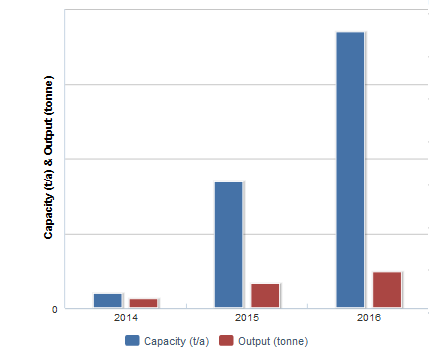

Capacity and Output of Trehalose in China

Source: CCM

The

People’s Republic of China has grown production steadily of its functional

oligosaccharide commodities in the last decades and especially in the recent

three years. The investment into the healthy sweeteners started in the 1990s

and still holds on, slowly getting more attention from consumers. After the

USA, Europe and Japan, China is now playing a major role in the global

Oligosaccharide supply chain.

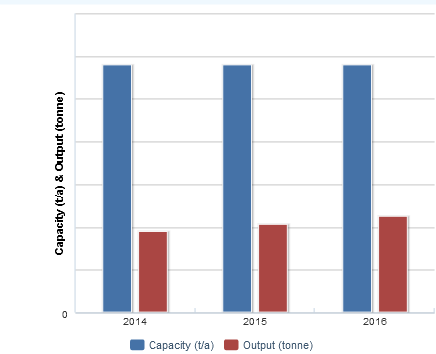

However,

contradicting to the surging production in recent years by several

manufacturers, especially major players like Baolingbao Biology, Shandong

Longlive, and New Francisco, the demand did not grow in line, which led to a

severe overcapacity in China’s market.

The

most important functional oligosaccharide for China’s

market are isomalto-oligosaccharide, fructo-oligosaccharide,

soybean

oligosaccharide, galacto-oligosaccharide, xylo-oligosaccharide, and

trehalose. These all have experienced different development in China in recent years,

with changing growth in demand and production, but all of them are running way

under the production capacity. In some extremes, oligosaccharide products are

facing such a sluggish demand that the industry witnessed production rates

under 13% of the possible capacity. All in all, the production was much lower

than the capacity for all oligosaccharide products in recent years.

Functional

oligosaccharide are replacing sucrose in many downstream

applications, since they are attributed to have very beneficial effects on the

human health, low calorie, and still show significant sweetener abilities.

Especially the increasing consumption of healthy products in China’s growing

middle class has pushed the demand for functional oligosaccharide as a

replacement for traditional starch sugars.

As

excellent dietary fibres or prebiotics, the demands on oligosaccharide from

infant formula, functional beverage, yoghurt, slimming products are increasing

incredibly in China, giving hope to manufacturers that the awareness is finally

growing faster and demand will follow soon.

In

the international competition, Chinese manufacturers own the advantages as

enormous raw material supply, for example from non-genetic modified corn, lower

labour cost, and government support on industrial and tax policies.

Capacity and Output of isomalto-olisaccharide in China

Source: CCM

About

functional oligosaccharide

Functional

oligosaccharide are enjoying growing demand worldwide as prebiotic

food ingredients used in various applications. The major prebiotic

oligosaccharides on global markets are inulin, fructo-oligosaccharides,

and galacto-oligosaccharides.

The

functional oligosaccharides can be processed from various origins, including

sources like viruses, bacteria, plants and fungi. Recently these food

ingredients have been seen a wider usage scope, ranging from pharmacological

supplements, food ingredients, and regulation of glucose control for diabetic

patients to reducing serum lipid levels in hyperlipidemic and other some acute

and chronic diseases.

Oligosaccharide

category is a rising star in food sweetener products family due to its health

functions. As novel sweeteners, oligosaccharides are used in a variety of

end-use products as food, drink, dietary supplement, pharmaceutical and animal

feeds. Particularly in foods, it’s can be added as an alternative sweetener of

sugar.

About this article

The

information of this article comes from the market research report Production

of Functional Oligosaccharides in China, 2014-2016 by Chinese market

intelligence firm CCM. Click on the link to see the report description.

CCM

is China’s leading market intelligence firm in the fields of Food

ingredients, Agriculture, and Chemicals. For more information on our research

scope, please contact our team at econtact@cnchemicals.com.